wyoming tax rates for retirees

Wyomings tax system ranks. The 1352 median annual.

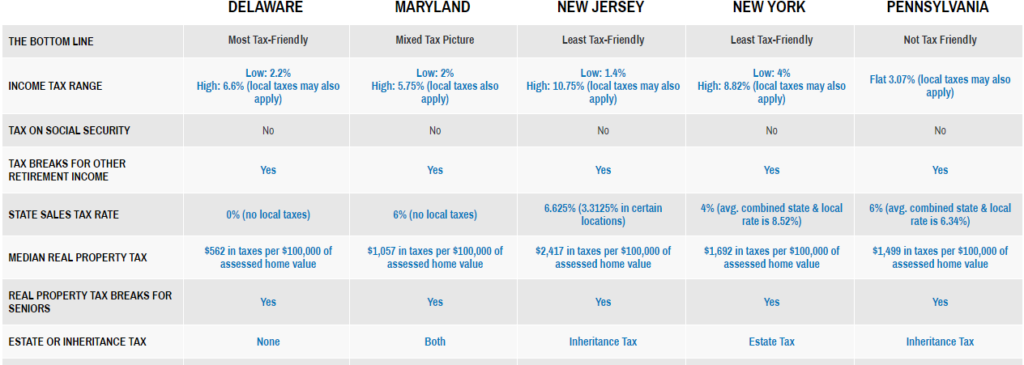

Evaluating Where To Retire Pennsylvania Vs Surrounding States Rodgers Associates

Income tax rates are also relatively low for most retirees and getting lower.

. Low Tax State 1. State tax rates and rules for income sales property estate and other taxes that impact retirees. Withdrawals from retirement accounts are not taxed.

Retirement income tax breaks start at age 55 and increase at age 65. Does Wyoming tax retirement pensions. Counties in Wyoming collect local sales taxes of up to 2.

A two-bracket tax rate structure is adopted starting in 2022 255 and 298. In fact its one of the lowest tax states for residents of any. Wyoming and Colorado are.

Marginal Income Tax Rates. It has no income tax so all pension Social Security and payments from retirement. Wyoming has a 400 percent state sales tax a max local sales tax rate of 200 percent and an average combined state and local sales tax rate of 522 percent.

The best option for a retirement state between Wyoming and Colorado is Wyoming. Exemptions for Retirement Income. Social Security income is not taxed.

Wyoming has no state income tax. Wyoming tops the list of friendliest tax states for retirees. And the 10 least tax-friendly states for retirees opens in new tab.

Not only that but Wyoming also boasts the lowest sales tax in the United States. Wyomings sales tax is 4. Contact Info Change Direct Deposit Change Online Pension Account Help Payroll Statements.

The states average effective property tax rate is 057 10th-lowest in the country including Washington DC. Wages are taxed at normal rates and. More About This Page.

Wyoming is very tax-friendly toward retirees. Colorados tax relief for retirees pales in comparison to what Wyoming offers. Pension plan contribution rate information and history for WRS employers.

There is zero state income tax in Wyoming and that applies to retirement income as well. The table below shows the total. Ad Learn More About the.

Mortgage rates in Wyoming. Because it has no income tax all pension Social Security and payments from retirement accounts are not taxed at the state level. Wyoming has one of the lowest median property tax rates in the country.

Wyoming The Most Tax Free.

States With The Highest Lowest Tax Rates

The Most And Least Tax Friendly Us States

Wyoming Tax Rates Rankings Wyoming State Taxes Tax Foundation

West Virginia Is Third Best State For Retirement Survey Says Wboy Com

Wyoming Taxes Wy State Income Tax Calculator Community Tax

Do You Have To Pay Tax On Your Social Security Benefits Greenbush Financial Group

State Income Tax Rates Highest Lowest 2021 Changes

Wyoming Sales Tax Calculator And Local Rates 2021 Wise

Which States Are Best For Retirement Financial Samurai

Wyoming Income Tax Calculator Smartasset

State Tax Levels In The United States Wikipedia

Best Worst States To Retire In 2022 Guide

Taxes In Retirement How All 50 States Tax Retirees Kiplinger

Top Income Tax Rate By State States With No Income Tax 1 Alaska 2 Florida 3 Nevada 4 South Dakota 5 T Retirement Retirement Income Retirement Locations

2021 State Corporate Tax Rates And Brackets Tax Foundation

Surprising Data Reveals The Top 25 Tax Friendly States To Retire Gobankingrates

Taxes The Most And Least Friendly States For Retirees